- Top-rated Best Lawyer in Noida

- +91 96161-66166

- [email protected]

Complete Step-by-Step Guide to the Divorce Process in Noida – Everything You Need to Know

May 28, 2025Divorce Lawyer Fees in Noida: A Comprehensive Guide

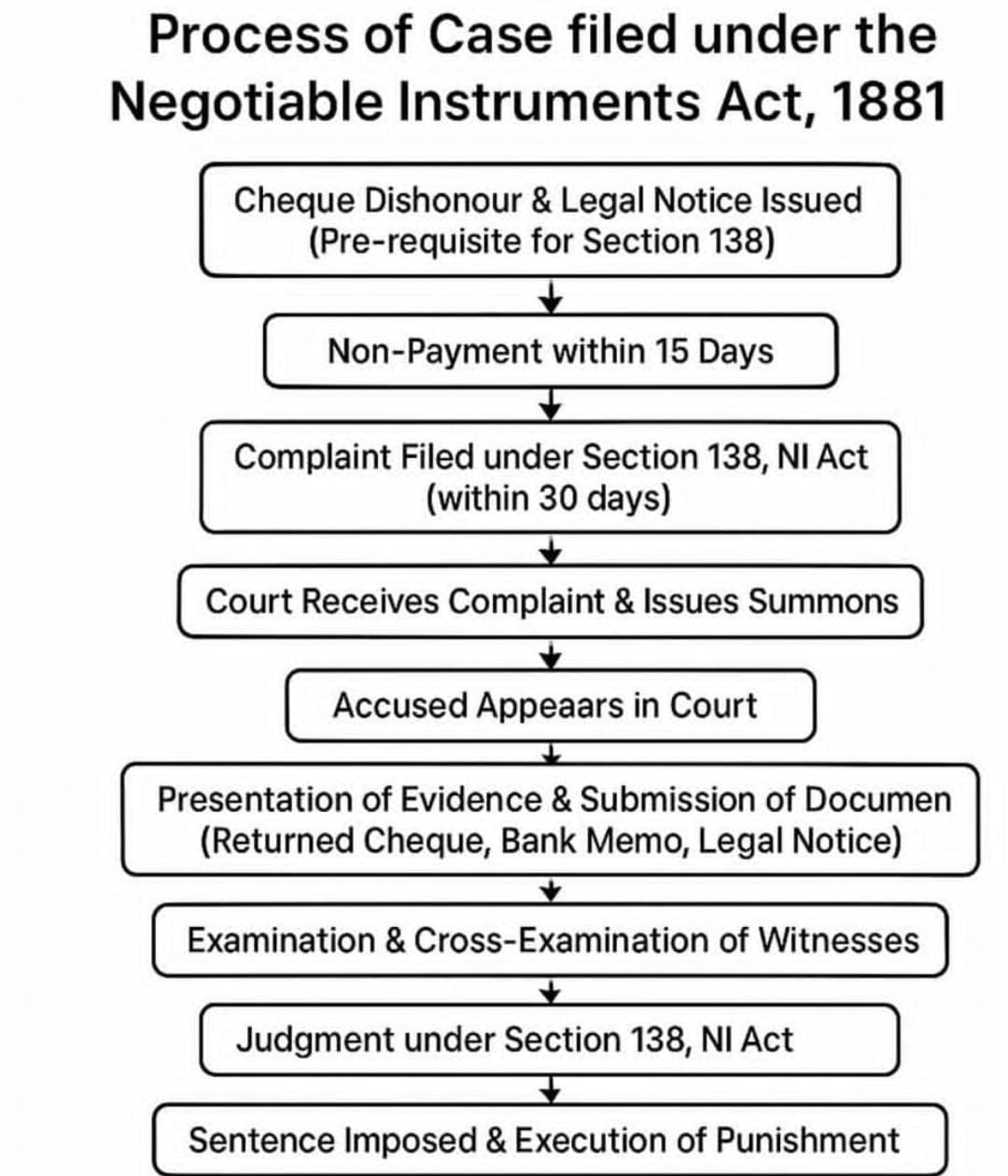

July 22, 2025In today’s digital and fast-moving economy, post-dated cheques are often used as a mode of securing payments in business transactions, property deals, personal loans, and service contracts. However, when such cheques are returned by the bank unpaid due to “insufficient funds” or any other reason, it creates serious financial setbacks for the payee. To address this issue and ensure the credibility of cheque-based transactions, the Indian government introduced Section 138 of the Negotiable Instruments Act, 1881, which makes cheque dishonour a criminal offense. This provision provides a strong legal remedy to individuals and businesses alike. In this blog, we will guide you through the step-by-step legal process involved in filing and fighting a cheque bounce case in India.

1. Cheque Dishonour and Legal Notice Issued

The first legal requirement to initiate action under Section 138 begins when the cheque issued by the drawer is returned or dishonoured by the bank. Dishonour can occur for several reasons such as insufficient account balance, mismatch in signature, account closure, or stop payment instructions. Once the payee receives the return memo from the bank, they must take action within 30 days by sending a legal notice to the drawer. This notice should be sent through registered post, courier, or another legally acceptable method, and must mention the date of cheque issuance, amount, cheque number, and the reason for dishonour. It must also clearly demand that the drawer make the payment within 15 days from the date of receiving the notice. Failing to send this legal notice within the prescribed timeframe may result in the case being rejected on technical grounds. Therefore, it is crucial to hire an experienced lawyer to draft and serve the notice properly.

2. No Payment Made Within 15 Days After Notice

The second step in the process is the 15-day waiting period granted to the drawer of the dishonoured cheque. After receiving the legal notice, the drawer is given this window to settle the matter by paying the amount due. This provision ensures a fair chance for resolution outside of court. However, if the drawer fails or refuses to make the payment within this legally defined time, the matter escalates into a punishable offense under Section 138 of the NI Act. It is important to note that even if the drawer claims that the cheque was issued as a gift or as security, the liability does not end unless the drawer proves that there was no legally enforceable debt or liability. Hence, after 15 days of non-payment, the payee earns the right to move the court and file a criminal complaint. This non-response is considered strong evidence of intent to cheat or defraud the payee.

3. Complaint Filing Under Section 138 (Within 30 Days)

If the payment is not received within the 15 days, the complainant has to act quickly and file a formal complaint in the magistrate's court under Section 138 of the NI Act. The timeline to file the complaint is within 30 days from the expiry of the 15-day payment period. The complaint must include the original cheque, a copy of the legal notice, the bank return memo indicating the dishonour, and the acknowledgment or postal proof of the notice being sent. The jurisdiction of the court is usually based on the location where the cheque was deposited or dishonoured. Filing beyond the prescribed time limit can weaken the case, unless the complainant provides a strong and valid reason for the delay, which the court may or may not accept. Legal assistance becomes vital here to ensure that all documents are presented correctly, and timelines are met without error.

4. Court Accepts Complaint and Issues Summons

Once the court receives the complaint, it reviews the affidavit and attached evidence. If the magistrate finds that there is a prima facie case under Section 138, then the court proceeds to issue summons to the accused. This summon is a formal direction asking the accused to appear before the court on a particular date. If the accused fails to appear despite being served, the court can escalate the matter by issuing bailable or non-bailable warrants depending on the severity and conduct of the accused. It is at this stage that the matter becomes officially registered, and the accused is now answerable to the judicial process. Timely service of summons and the response of the accused determine how quickly the case proceeds. Often, settlement negotiations also begin once the accused receives the summon and realizes the seriousness of the complaint.

5. Accused Appears in Court

After receiving the court's summon, the accused must appear in front of the magistrate on the specified date. At this stage, the court may grant bail depending on the situation, especially if the accused is cooperative and shows willingness to resolve the matter. The accused can also plead guilty or not guilty. In some cases, the accused may try to settle the matter immediately by offering a payment, and if the complainant agrees, the matter can be closed with the court's permission. However, if no settlement is reached, the trial officially begins. The court will record the initial stance of the accused and set a schedule for the hearing of evidence. This stage is crucial because any non-appearance or evasion by the accused can result in stricter action, including warrants and freezing of assets.

6. Submission of Evidence by Complainant

During the trial, the complainant is given the opportunity to submit all relevant documents and evidence supporting their claim. This includes the original dishonoured cheque, the bank return memo, the copy of the legal notice served to the accused, and proof of delivery such as speed post receipts, courier acknowledgments, or email trails if applicable. The complainant also files a sworn affidavit describing the transaction details, purpose of the cheque, and events after dishonour. Proper documentation significantly strengthens the case and demonstrates to the court that all necessary steps were taken in accordance with the law. In some cases, additional supporting documents such as loan agreements, transaction records, or bank statements may also be submitted to establish the background of the liability.

7. Examination and Cross-Examination of Witnesses

Once the documentary evidence is submitted, the court begins the process of examining the witnesses. The complainant may be called to the stand for an examination-in-chief, where they are questioned by their lawyer to present their version of the events. Following this, the defense lawyer will conduct a cross-examination to test the complainant's credibility and challenge the claims made. Similarly, the accused may also produce witnesses and be subject to examination and cross-examination. This phase is vital, as the strength of the case often depends on how clearly and confidently the complainant and their witnesses testify. The court carefully evaluates the body language, consistency, and supporting evidence during this stage before moving forward.

8. Final Judgment by Magistrate under Section 138

After hearing all arguments and reviewing the evidence, the court pronounces its judgment. If the accused is found guilty, the court may order imprisonment of up to two years, a fine up to twice the cheque amount, or both. The judgment also includes directions for repayment and may include interest. However, if the court is convinced that the accused had no intention to defraud or there was a valid defense, the complaint may be dismissed. The decision is based on merit, documentation, witness testimony, and overall conduct of both parties. A well-prepared case with clear evidence and legal guidance usually results in a favourable judgment for the complainant.

9. Sentence Execution and Recovery of Dues

If the judgment is in favour of the complainant, the court ensures execution of punishment. If the accused is sentenced to pay a fine or compensate the complainant, and still fails to do so, the court can initiate recovery proceedings, attach movable or immovable property, and even send the accused to judicial custody. Execution is the final step where justice is not just declared but enforced. The complainant may also choose to file a civil recovery suit for the cheque amount along with interest and damages. At this stage, having a persistent and resourceful legal team is critical to ensure that the court’s order is implemented fully and promptly.

Why You Need a Skilled Cheque Bounce Lawyer in Noida

Cheque bounce cases may appear straightforward, but they are full of technical procedures, strict deadlines, and detailed documentation. Missing even a single deadline can lead to case dismissal or weaken your position in court. Therefore, hiring a professional and experienced lawyer who understands the nuances of Section 138 is crucial. At LawyerInNoida.com, we offer dedicated legal support for cheque bounce matters—from sending the legal notice and filing the complaint to representing you in court and securing justice. Our team understands how to use legal provisions to your advantage while ensuring full compliance with procedural laws.

Conclusion

Cheque bounce is not just a financial loss; it's a legal breach of trust. Section 138 of the NI Act empowers you to seek compensation and punish the wrongdoer. But to successfully fight a cheque dishonour case, you must act promptly, document everything properly, and follow the prescribed legal process. With the help of a seasoned legal team, you can turn a stressful financial issue into a strong legal win. Whether you are a business owner, service provider, or an individual who has been cheated, justice is within your reach—provided you take the right legal steps at the right time.

📞 Need Legal Assistance for a Cheque Bounce Case in Noida?

Contact our expert lawyers now for quick and reliable legal advice.

- 📱 Call: +91-9616166166

- 🌐 Visit: https://lawyerinnoida.com